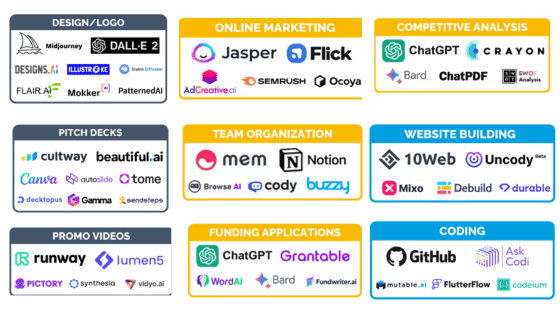

Applying for grants has the potential to significantly impact startups by providing essential funds and resources for their growth. However, the application process is often intricate, demanding, and time-consuming, requiring startups to create compelling narratives, meet specific criteria, and present accurate financial projections.

Recent posts by Eric Weber

3 min read

Enhancing startup grant applications with ChatGPT

By Eric Weber on 21 August 2023

Topics: Startup Tips startups

7 min read

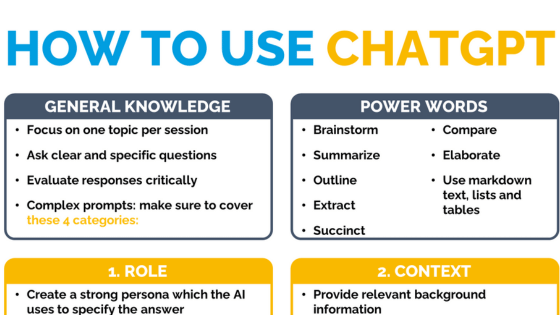

Essential AI tools every startup should know about

By Eric Weber on 19 July 2023

As a founder, you face a lot of challenges - from product development to team management to customer support. In this dynamic startup world, AI tools have become an indispensable ally for overcoming these challenges and propelling success. In this article, we introduce you to top AI tools for your startup.

Topics: Startup Tips startups

20 min read

The future of nuclear energy in Germany

By Eric Weber on 04 August 2022

Crises have been weighing on the global economy for almost two years. The energy industry in particular has been hammered by the Ukraine invasion as oil and gas imports from Russian sources are now realized with big (ethical) question marks. Rising prices, supply bottlenecks and alarmingly empty storage facilities have been the result, not only in Germany. Already in September 2019 – long before the war - the German government declared an “emergency plan” with three levels and reached level 2 (alert level) end of June 2022. At level 2, the goal is to fill gas storages by reducing gas consumption, e.g. through reducing the electricity production with gas power plants. For these reasons, the discussion on nuclear power has gained new momentum. Even the German Minister of Finance Christian Lindner - contrary to his statement from the end of 2021 - wants to rekindle a debate on nuclear power. But what does the situation actually look like and how realistic is a return to nuclear power really?

Topics: energy

6 min read

10 reasons why SpinLab is interesting for more established startups

By Eric Weber on 11 January 2022

You have come across our Accelerator program, but you are not quite sure if it is suitable for your startup? We often receive questions from established startups asking whether they still fit into the program and what added value the participation has. In this article, we will show you 10 strong arguments why established startups should definitely apply for our free program. Let's go!

Topics: Startup Tips applynow

8 min read

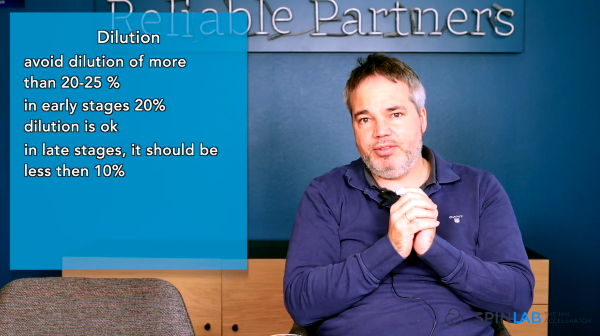

Guidelines to avoid broken cap tables

By Eric Weber on 20 September 2021

A cap table- short name for “capitalization table”- is a spreadsheet with an overview of who owns a portion of equity of a company and how this equity is distributed among shareholders. When entrepreneurs are looking for financing rounds, the cap table is one of the main files that investors will check to assess whether the venture has a healthy distribution of equity or not. Generally, investors prefer cap tables where all or at least the vast majority of shareholders will contribute to value creation in the future. In some cases, entrepreneurs with appealing and promising business ideas miss funding opportunities due to the so-called broken cap tables. This refers to an inadequate distribution of equity among shareholders or inacceptable terms and conditions, which generates misalignment of interests or interferes with an efficient business management. As a result, the startup losses the ability to raise funds or requires going through a painful restructuring process.

Topics: Startup Tips startups

12 min read

A step by step guide to build a cap table

By Eric Weber on 06 September 2021

When preparing financial rounds, investors usually ask for cap tables (short version for “capitalization table”). Basically, this is a list or spreadsheet with an overview of all shareholders who have a participation on your company. Sounds easy? But in fact it isn’t, especially in later financing rounds. Why? Well, in the easiest case is the simple share distribution to founders and investors round by round, but in practice the deal structures are more complex. Typically, due to special rights and agreements, the allocation of equity shares deviates from voting rights and from money proceeds distributed after a cash event like an exit (e.g. a trade sale or an IPO). Very often it is complex enough to hire (and pay) external consultants and lawyers to reproduce the contractually fixed distribution and it is a frequent discussion point in due diligence processes on that way. Thus, it is worth paying some attention right from the beginning.

Topics: Startup Tips Learnings

12 min read

Venture Capital Definitions: Important Deal Terms in Plain Language (2020)

By Eric Weber on 26 January 2021

Especially during the current pandemic it would be very hard to live without some of our favourite products/services, that mostly appeared since the beginning of the millenium: Facebook, Twitter, Amazon, Spotify, HelloFresh - just to name a few.

Although these and other favourite products of generations x, y & z are very different in nature, they often have 1 thing in common: venture capital. Some would even argue that without venture capital financing some of these products wouldn’t even exist today. Nevertheless it is almost guaranteed that those products would be different or their wider adoption level would be less without venture capital.

But what exactly is venture capital?

While Venture Capital (VC) is among the most preferred and frequently used financing options for startups, many founders are not very familiar with the definitions of various venture capital contractual terms – sometimes even after an investment has already taken place. For the sake of fairness, these contractual terms are quite complex and thus contracts are quite long.

Since VC contracts are private agreements, individual arrangements and wordings are up on negotiation. However, there is a basic set of frequently used mechanisms that can be considered somewhat “standard terms.” Still, in contracts – as well as in the dozens of books, presentations and many blogs and comments on those – the language used is formal and based on legal standards.

Therefore, they are close to what founders will officially sign, but are still difficult to understand for beginners.

Topics: Startup Tips

10 min read

International Venture Capital and Forced Exits: Recapping HHL SpinLab Investors Day 4

By Eric Weber on 18 February 2020

About 200 venture capitalists, family offices and business angels mingled with our corporate partners and startups during the fourth HHL SpinLab Investors Day.

With networking sessions, inspiring speeches and panels accompanied by top-notch startup pitches, the likeminded community enjoyed the event. Focusing on the topics “Investing with international venture capitals” and “How to force exits?” both investors and founders were able to discuss important aspects of the same topics from their perspectives.

Topics: Learnings

8 min read

Why the German Venture Capital gap is not (only) in later stage

By Eric Weber on 25 July 2019

In the last years we saw many speeches by top German politicians of different parties who agreed that Germany performs badly compared to the United States, Israel or China when it comes to Venture Capital, due to the identified lack of Later Stage investments.

Topics: Learnings

6 min read

Team Due Diligence and Venture Capital Brand Building – Key take aways from HHL SpinLab Investors Day

By Eric Weber on 13 June 2019

The HHL SpinLab Investors Day in June 2019 took place at the location with the best view over Leipzig! At the Felix - just across Augustusplatz – 170 investors, partners and startups met and engaged in several activities like keynotes and panels on special venture capital (VC) know-how as well as startup pitches and speed dating. Central topics of this year’s Investor Day were Team Due Diligence and Brand Management as VC.

/White%20Versions/stadt_leipzig_white.png?width=130&name=stadt_leipzig_white.png)

/lfca_white.png?width=119&name=lfca_white.png)

/bmwi-white-engl-2022.png?width=573&name=bmwi-white-engl-2022.png)

/White%20Versions/sachsen_signet_white.png?width=90&height=362&name=sachsen_signet_white.png)