When preparing financial rounds, investors usually ask for cap tables (short version for “capitalization table”). Basically, this is a list or spreadsheet with an overview of all shareholders who have a participation on your company. Sounds easy? But in fact it isn’t, especially in later financing rounds. Why? Well, in the easiest case is the simple share distribution to founders and investors round by round, but in practice the deal structures are more complex. Typically, due to special rights and agreements, the allocation of equity shares deviates from voting rights and from money proceeds distributed after a cash event like an exit (e.g. a trade sale or an IPO). Very often it is complex enough to hire (and pay) external consultants and lawyers to reproduce the contractually fixed distribution and it is a frequent discussion point in due diligence processes on that way. Thus, it is worth paying some attention right from the beginning.

To better understand the importance of building a clear and complete cap table from the beginning, here are some questions of interest to you and your prospect investors that the cap table will help you answer:

- How much money have founders and other investors invested to gain what share on the startup and how has their equity position changed with each financing round?

- How big are the company’s Employee Stock Option Programs (ESOP)?

- How has the valuation of the company and the share price evolved over time?

- How much money will be distributed to each shareholder if the company is eventually sold?

- How are voting rights distributed among shareholders?

Let us walk you through the construction of a cap table highlighting key aspects you need to consider before beginning the funding round research for your startup.

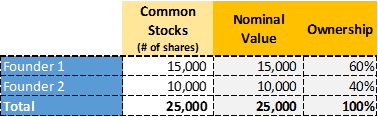

Initial cap table

Usually, founders start with a simple Excel spreadsheet or alike. In later stages, you can use specialized tools like Ledgy that make it more convenient and comprehensive. At the very beginning you start to represent your founder’s equity structure. Let us consider the following example: You are a team of two founders, one owning 60% and the other one 40% of a German GmbH (limited liability holding). The total initial investment accounts for 25.000 € (15.000 € paid by founder 1 and 10.000 € by founder 2). For each Euro paid in, the founders receive one share (defined as the nominal value), which typically represents the voting rights in shareholder meetings, but also the distribution of cash in liquidity events (e.g. the liquidation of the company, payment of dividends etc.).

This is how the first cap table would look like in our example:

To grow your business, you will need to start looking for funds with investors who will certainly ask you to comply with some requirements and provide them with specific information in your cap table to assess your business. Let us look at key aspects that you should consider when building your cap table.

First investment round: Angel investors

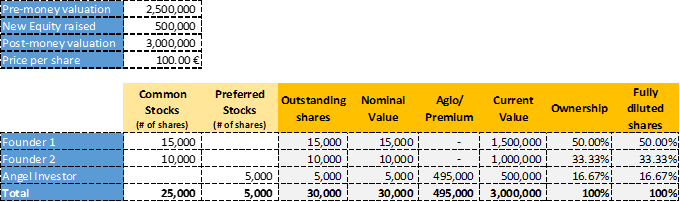

Typically, startups invite external investors (everything from Business Angels to international Venture Capital funds) as new shareholders to provide fresh capital in an investment round. Initially, early capital will often be provided by angel investors (business angels). Before receiving the funds, a pre-money valuation of the venture is agreed between you and the investors, and an investment amount for this round will be settled accordingly. These values (pre-money valuation and investment amount) are registered in the cap table and a post-money valuation is then calculated by adding the investors funding amount to the pre-money valuation.

Let’s consider you agreed on a pre-money valuation of 2.5 Mio. € and the angel investor decides to provide 500k € for the venture. As a result, the post-money valuation of your company will be equal to 3 Mio. €.

An important metric that must now be assessed in the cap table is the price of your company’s shares. To calculate the new price for this founding round, the pre-money valuation is divided by the number of shares (nominal value) prior to the investment. In our example, the pre-money valuation of 2.5 Mio. € is divided by 25,000. As a result, the price per share paid by the investors in this round will be equal to 100.00 €. Consider that the share price will change as the valuation of the company evolves with each next funding round, and therefore the shareholders’ investment (which is measured according to changes in the price per share) must be monitored with the cap table.

The received funds increase the number of outstanding shares of your company and as these angel investors are new shareholders, they must receive the number of stocks based on their invested capital. To do so, divide the invested amount of 500k € by the price per share, which results in a total quantity of 5,000 shares that angel investors should receive. Take into account that investors demand several preferential conditions tied to their investment including voting rights in the company’s decisions, liquidation preferences, anti-dilution rights, vesting or probably adjustments in the ESOP pool. For this reason, they are granted preferred stocks.

Given the increase in the number of shares, the percentage of equity initially assigned to the founders will be reduced. This effect is known as dilution, which means a decrease in the portion of the company that has been assigned to existing shareholders. To calculate the shareholders’ diluted participation, we proceed to divide the number of shares assigned to each shareholder by the new total nominal value of stocks. In our example, the total number of shares will amount to 30,000 (25,000 initially distributed to founders, and 5,000 new issued shares). In this case, the ownership of founder 1 is gets diluted to 50.00%, for founder 2 to 33.33%, and angel investors will gain a participation of 16.67% on the company.

Notice that we added a column under the name of Agio. Agio (also known as premium) refers to the difference between the amount paid by investors for their shares and the nominal value of these shares. In our example, the nominal value of a share is 1,00 € per share, which differs from the real value that angel investors paid (100,00 € per share). In this case, angel investors paid a premium of 495,000 € for the total amount of shares bought (5,000 shares multiplied by 100,00 € minus the nominal value of 5,000).

Additionally, in the column named Current Value we can see how much worth are the stocks of each shareholder in this round. In the case of founder 1, the value of its 15,000 shares is now 1.5 Mio. € calculated by multiplying the number of shares by the new price per share of 100,00 €.

Second financing round: VC and Employee Stock Option Program (ESOP)

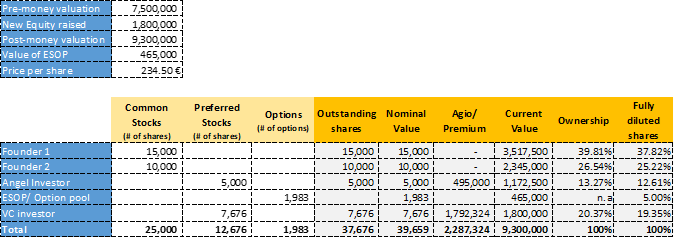

Now that you have made good progress with the first angel round, your startup is gaining recognition among significant customers and you need more resources – e.g. team members - to keep growing, then you could now consider doing a second financing round with a Venture Capital (VC) fund.

VC investors will inject capital to startups subject to certain requirements to limit the risk of their investments (through preferred shares) but also to maximize the probabilities of success of the company. For the latter, institutional investors demand founders to provide key employees with an incentive to stay in the company, work diligently and create value for the business. This shall be achieved by offering Employee Stock Option Programs (ESOPs) or Option Pools, which are used as a form of compensation that allows key employees to participate in the distribution of earnings when the startup will be liquidated. To create an ESOP, the company defines a percentage of the total equity (or exit proceeds in the case of so-called Virtual or Phantom shares in VSOP programs) that must be reserved for employees, which in Germany typically ranges between 5% and 10%, while in other regions it can raise up to 20% (e.g. US).

Let’s move on with our example and assume that at this stage, you and your investors agreed on a pre-money valuation of 7.5 Mio. € and a new capital investment of 1.8 Mio. €. Further, the new VC investors demand 5% of the equity to be used for the ESOP. Consider that new investors often require that the ESOP shares should be created on a pre-money basis, which means that adding an ESOP will only dilute the existing shareholders participation. In this case, there will be an increase in the number of shares prior to the new investors’ cash injection, which as a consequence impacts the pre-money valuation of the startup and therefore the price per share paid by the new investors will be lower. In our example, a new price per share of 234.50 € will result by subtracting the value of the ESOP from the initially stablished pre-money valuation of 7.5 Mio. €, and dividing this value by the existing number of shares (30,000).

Now we need to find the new total number of shares (including current outstanding shares and those issued for the ESOP and VC investors) needed to complete 100% of the company. First, we know that the participation of VC investors in the company is equivalent to 19.35% which corresponds to the portion of their injected capital with respect to the company’s post money valuation (1.8 Mio. €. / 9.3 Mio. €). Furthermore, given that 5% should be assigned to the ESOP, then a remaining 75.65% will be allocated among existing shareholders depending on their ownership ratios. We then calculate a total number of securities amounting to 39,659 (or 30.000 / (1 – 5% – 19.35%).

In the cap table, the effect of the option pool is included in the column commonly referred as Fully diluted shares and reflects the shareholders’ participation in proportion to the total number of shares and options issued by the venture. In this case, the participation of founders and angel investors gets diluted due to the creation of the option pool and to the issuance of 7,676 shares for VC investors. The VC fully diluted shares in the company account for 19.35% meaning that they give away part of their participation when it comes to liquidity events, but their legal ownership in the company will be higher (20.37%). An updated version of the cap table would look this way:

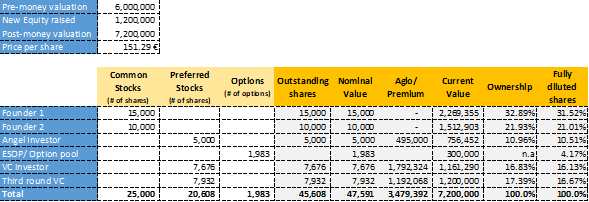

Third round: Down-rounds

So far, your start-up has been growing steadily, and its value has increased with each financing round. However, things might not work out always in the same way. Down-rounds occur when a company raises additional funds at a share price which is below previous rounds’ share price. This occurs if the pre-money valuation is lower than the post-money valuation from former financing rounds. In this case, the value of the existing shareholders’ investment decreases, which reveals a negative signaling to investors and compromises their confidence about the startup’s performance. Reasons explaining down-rounds include failure to meet earnings’ targets, increase in the competitive environment, overvaluation in previous rounds, among other reasons.

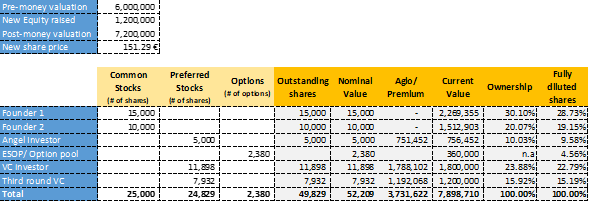

To understand the effect of a down-round, let’s extend our previous example and assume a third funding round with VC investors where the pre-money valuation of the startup is decreased from 7.5 Mio. € in the second round to 6 Mio. € in this round. Therefore, third round investors will be paying 151.29 € per share below a price of 234.50 € paid in the second financing round. In case of a down-round, your venture will still receive capital, but the value of each of the shareholders’ stocks will decrease significantly.

The impact on the cap table (without any protection provisions) will be the following:

As previously mentioned, investors usually request preferred shares when committing capital to a venture, as preferred shareholders will benefit from certain rights intended to protect their investment. Anti-dilution provisions represent a type of protection against down rounds, which prevents investors’ equity from losing value. A way to compensate investors from a decrease in their stocks’ value, is the so-called full-ratchet method which converts the price of shares purchased in previous rounds to the price of the current down round. This means that preferred shareholders will be treated as if they had purchased stocks at the new lower price, and as a result protected shareholders will be rewarded with additional shares.

Coming back to our example, second round VC investors will be protected with the anti-dilution provision and their conversion price will be adjusted from 234.50 € to 151.29 €. Therefore, this price adjustment will result in an increase in the number of stocks owned by the protected investors. To calculate the new number of shares owned, divide the VC’s invested amount by the new issuance price per share. After including the anti-dilution provision, the final cap table will look as follows:

Exit Scenarios

Investors seek to fund companies with high growing potential and envisioned to be bought for a high price enough to give a very appealing return on investment. The cap table will allow you to show investors (in particular in later funding stages) your forecasted exit valuation and how much money will shareholders be compensated with.

There are different ways to calculate and negotiate the exit value of your startup, based on rough estimations of the future potential of the business. With the purpose of illustrating the distribution of exit proceeds under a pro-rata basis, let’s use a multiple valuation method in our fictive example. Let us assume that according to our forecasts, after 7 years the company’s revenue will reach 30 Mio. €, and the company will be sold for a revenue multiple of 2X according to past transactions of peer companies. The last column of the cap table shows each stakeholder’s fully diluted ownership multiplied by the exit valuation of 60 Mio. €.

The cap table shows that founder 1 is very well rewarded with exit proceeds of 17.24 Mio. € compared to the initial invested amount of 15k €, angel investors received 5.75 Mio. €, second and third round VC investors earned 7.6X their initial investment or 13.67 Mio. € and 9.12 Mio. € respectively.

Another way to influence exit proceeds are the so-called liquidation preferences, which owners of preferred shares usually benefit from. This is a contractual term which serves to mitigate the high-risk investors are taking when injecting money in a startup by receiving proceeds from the liquidation in advance of other share classes. You also need to agree with preferred shareholders about the type of liquidation preference they will receive: participating or non-participating. With participating stocks, shareholders will be entitled to a preferential payment equivalent to their initial investment and then receive their percentage of the remaining proceeds on an “as-converted to common stock basis”, which means a pro-rata distribution of any gains. Let’s assume that third round VC investors in our example have a 1X participating liquidation preference. If the company is sold for 60 Mio. €, third round investors will receive their 1.2 Mio. € invested amount, and the remaining 58.8 Mio. € will be distributed among the rest of the shareholders on a pro-rata base. This means that third round VC investors will receive 15.19% of 58.8 Mio. €, which corresponds to 8.93 Mio. € in addition to the 1.2 Mio. €.

On the other hand, with non-participating liquidation preference shareholders will have the option to either 1) exercise their liquidation preference or 2) convert their preferred stocks to common stocks and share the exit proceeds on a pro-rata basis with common shareholders. In our example, third round VC investors could either receive their 1.2 Mio € invested capital or 15.19% of the 60 Mio. € exit proceeds, which will amount to 9.12 Mio. €. In this case, third round VC investors will not execute their liquidation preference in order to receive higher proceeds.

There are multiple ways to design preferential rights which lead to a significant distortion on the allocation of exit proceeds among shareholders.

Conclusion

When looking for financing rounds, your cap table is one of the main files that investors will check to assess their investment decision. An updated and clean cap table will give prospective investors a detailed description of the company’s equity structure, evolution of the venture’s value and a projected return on investment.

//Article written in collaboration with Andrea Escorcia and Livia Jansen-Winkeln MSc students from HHL Leipzig Graduate School of Management.

/RootCamp_Logo-Ecosystem.png?width=200&name=RootCamp_Logo-Ecosystem.png)

/Bitroad_Logo-Ecosystem.png?width=200&name=Bitroad_Logo-Ecosystem.png)

/White%20Versions/stadt_leipzig_white.png?width=130&name=stadt_leipzig_white.png)

/lfca_white.png?width=119&name=lfca_white.png)

/bmwi-white-engl-2022.png?width=573&name=bmwi-white-engl-2022.png)

/White%20Versions/sachsen_signet_white.png?width=90&height=362&name=sachsen_signet_white.png)