If one were to draw a comparison between startups and established companies, the metaphor of a newborn versus an adult might come to mind. Just as newborns go through an incubation phase and eventually face puberty before stepping out into the world, startups embark on a similar journey. They often start in an incubator or accelerator, undergoing a period of growth, and then emerge to either organically expand or be acquired.

5 min read

A startup’s search for its vision and mission… the quest for the holy grail?

By David Blazek on 23 August 2023

Topics: Startup Tips startups

3 min read

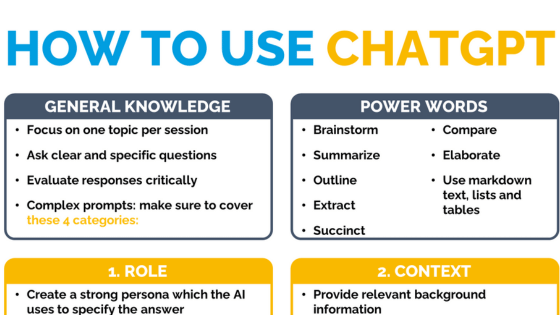

Enhancing startup grant applications with ChatGPT

By Eric Weber on 21 August 2023

Applying for grants has the potential to significantly impact startups by providing essential funds and resources for their growth. However, the application process is often intricate, demanding, and time-consuming, requiring startups to create compelling narratives, meet specific criteria, and present accurate financial projections.

Topics: Startup Tips startups

7 min read

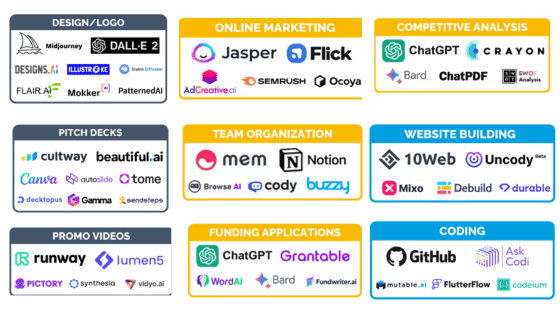

Essential AI tools every startup should know about

By Eric Weber on 19 July 2023

As a founder, you face a lot of challenges - from product development to team management to customer support. In this dynamic startup world, AI tools have become an indispensable ally for overcoming these challenges and propelling success. In this article, we introduce you to top AI tools for your startup.

Topics: Startup Tips startups

6 min read

10 promising energy startups in Germany you should know

By Linh Pham on 17 August 2022

Climate change and, most recently, Russia's invasion of Ukraine have plunged energy policy in crisis. In order to become independent of Russian oil and gas, numerous countries are currently putting their energy and climate policies on the test bench. Alternatives are needed. Times have never been more promising for founders in the energy sector. As the energy system undergoes a far-reaching transformation, new digital solutions, technologies and innovative business models are needed. In this article, we introduce you to upcoming energy startups from Germany.

Topics: Startup Bios startups energy

6 min read

Emerging venture capital alternatives for startups

By Linh Pham on 09 August 2022

Never before has so much venture capital flowed into startups as in the past year. 2021 was a record year with mega deals and new unicorns. For the first time ever, European startups raised over $100 billion. This represented a 115% increase in the funding amount from 2020. Currently, VC funding receives the most attention in the media. For young startups, it seems to be the best way of funding. However, there are more alternatives to the classic VC money. As part of the 13th edition of the HHL SpinLab Investors Day, Damian Polok (Silicon Valley Bank), Isabella Hermann-Schön (Round2 Capital), Paul Becker (re:cap) and Patrick Walsh (uncapped) came together in Leipzig to discuss venture capital alternatives. This panel dives into the questions whether the alternatives are in conflict with the VC world, what factors to be aware of when it comes to financing and how the diffrent options work.

Topics: startups Venture Capital Events

8 min read

Guidelines to avoid broken cap tables

By Eric Weber on 20 September 2021

A cap table- short name for “capitalization table”- is a spreadsheet with an overview of who owns a portion of equity of a company and how this equity is distributed among shareholders. When entrepreneurs are looking for financing rounds, the cap table is one of the main files that investors will check to assess whether the venture has a healthy distribution of equity or not. Generally, investors prefer cap tables where all or at least the vast majority of shareholders will contribute to value creation in the future. In some cases, entrepreneurs with appealing and promising business ideas miss funding opportunities due to the so-called broken cap tables. This refers to an inadequate distribution of equity among shareholders or inacceptable terms and conditions, which generates misalignment of interests or interferes with an efficient business management. As a result, the startup losses the ability to raise funds or requires going through a painful restructuring process.

/Top%2010%20Energy%20Startups%20in%20Germany.jpg)

/HHL%20SpinLab%20Investors%20Day%2013%20VC%20Alternatives%20Panel.jpg)

/Guidelines%20to%20avoid%20Broken%20Cap%20Tables.png)

/White%20Versions/stadt_leipzig_white.png?width=130&name=stadt_leipzig_white.png)

/lfca_white.png?width=119&name=lfca_white.png)

/White%20Versions/sachsen_signet_white.png?width=65&height=79&name=sachsen_signet_white.png)